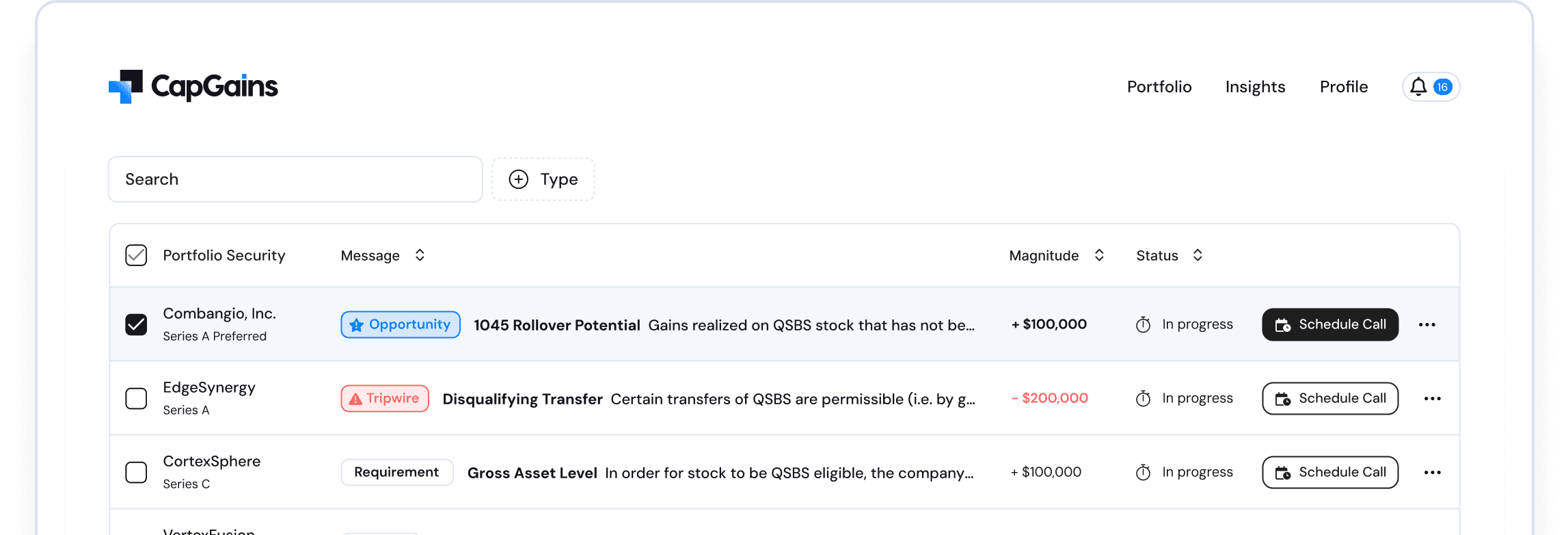

The tax incentive monitoring platform designed for fund CFOs.

CapGains helps VCs, angels, other shareholders and the companies they support maximize tax incentives by avoiding tripwires and unearthing opportunities.

How we're helping our customers avoid the tripwires and uncover hidden opportunities

exclamation-triangle

QSBS Tripwire

Disqualifying Transfer

It is common for new fund managers to transfer investments that had been made personally to the fund after launching the fund, however we didn’t realize that such transfers would result in the stock losing QSBS status in the new partner’s hands until CapGains took a look under the hood.”

exclamation-triangle

QSBS Requirement

Gross Asset Level

CapGains identified that the balance sheet reflected certain items which when adjusted for their tax basis put the level below the $50M threshold!

sack-dollar

QSBS Opportunity

1045 Rollover

CapGains identified that we actually made a qualifying rollover investment but hadn’t claimed it, making for an immediate 500% payback to our signing up for the platform!

exclamation-triangle

QSBS Tripwire

Related Party Redemptions

We don’t want to get burned by a QSBS tripwire again! A portfolio repurchased some of our stock and it caused all of our other shares of stock in the company to no longer qualify as QSBS!

exclamation-triangle

QSBS Requirement

Qualified Trade or Business Health

We didn’t think that certain companies in our portfolio could qualify for QSBS, however CapGains helped us better understand how the Qualified Trade criteria is evaluated in particular for Health Services businesses, and it turns out more of our portfolio could be QSBS eligible than we thought.

exclamation-triangle

QSBS Tripwire

Offsetting Short Position

We thought trading in derivatives would help protect our gains, however CapGains’ showed us how this caused us to taint our QSBS eligibility.

exclamation-triangle

QOZB Tripwire

Business Location

We thought the office location we selected was within an Opportunity Zone, but CapGains showed us that we were using the wrong map, and were across the street from the OZ!

sack-dollar

QSBS Opportunity

1045 Rollover

CapGains flagged an opportunity that our tax advisors missed, which allowed us to show our limited partners that there are extra benefits to participating in our additional fund! Namely, that an investment made by our newest fund can be treated as a qualifying 1045 reinvestment for eligible partners who participated in our first fund due to a liquidity event from the first fund.

sack-dollar

Section 1244 Opportunity

Loss Deduction

Many of the companies we help close up shop are relieved to be able to offer some of their investors the ability to deduct losses, and CapGains’ provides a great complement to our services in this regard.

exclamation-triangle

QSBS Tripwire

Treatment of Partners in Pass-Thru Entities

In our pilot with CapGains we learned that the way we structured our investments was shooting ourselves in the foot with QSBS as we were admitting partners to the fund after we made the investment!

Case Study

Learn how Primary Venture Partners leveraged QSBS in a secondary transaction to maximize returns for their LPs

CapGains is your trusted partner for getting tax incentives right.

A complete solution for your VC fund.

Upcoming Events

Dec 12, 2024, 6:00 PM

Unlocking the Full Potential of QSBS - Advanced Insights for Investors and Founders with JP Morgan, CapGains Inc. and Christopher Karachale of Hanson Bridgett LLP

Join us for an exclusive dinner with fellow investors and founders, where we will explore advanced strategies surrounding Qualified Small Business Stock (QSBS).

location-dot

Miami, FL (Location Provided upon registration)

Jan 8, 2025, 12:00 PM

What is QSBS? The Tax Benefit that Can Save You Millions (hosted by GoodFin)

Learn the basics of QSBS, how it can benefit you, and ways to maximize your chances to qualify

location-dot

Los Angeles, CA or virtual (Location provided upon registration)